Hot market outpaces listings

If you’d like to sell your home in Madison Park, now is clearly the time. In fact the opportunity seemed so good to my wife and me that we decided to sell. Our house was on the market for exactly a week. Now we’re living in a Madison Park rental.

Our quick-turn experience was not particularly noteworthy among recent sellers of Madison Park real estate. The area’s frothy market just doesn’t seem to be abating. There are simply too few listings for the many interested buyers waiting to pounce.

Winter is usually the slowest period for moving real estate; but even so, the inventory level in the neighborhood is shocking low. There are only 13 houses for sale in Madison Park as we go to press, and only two of these are located outside the neighborhood’s more-exclusive enclaves of Washington Park and Broadmoor.

With houses selling in record time the current listings are relatively fresh, with an average time on market of just 41 days. Almost half of those listings, six of thirteen, have entered the market within the last month. Meanwhile, there are just three condos for sale here. That’s perhaps a record low. For comparative purposes it’s worth noting at this same time of year in 2012, during the dead winter of the down market, there were 22 condo listings.

Here’s a quick snapshot of the housing that’s currently available for purchase in Madison Park, courtesy of Redfin:

Houses

Listings: 13

Median List Price: $2,890,000

Median Sq. Ft.: 4,590

Median Price per Sq. Ft.: $630

Average Days on Market: 41

Percentage with Price Reductions: 8%

New Listings: 6

Pendings: 7

Condos/Townhouses

Listings: 3

Median List Price: $700,000

Median Sq. Ft.: 1113

Median Price per Sq. Ft.: $629

Average Days on Market: 102

Percentage with Price Reductions: 66%

New Listings: 1

Pendings: 3

The accelerating sales pace of Madison Park’s real estate market is evident in several ways. In 2014 the 80 homes that sold spent a coincidental 80 days on the market, on average. Although more houses were sold in the previous year (103 to be precise), those 2013 sold homes remained on the market almost 20% longer: 98 days. There was also a compression year over year of the average discount at sale compared to the original listing price. The discount for 2014 was just 4.2%, compared to 6.9% in the previous year.

Here’s the breakdown of 2014 home sales:

Houses

Sales: 80

Median Sale Price: $1,434,000

Average Sq. Ft.: 3,425

Average Price per Sq. Ft.: $475

Average Days on Market: 80

Average Discount from List Price: 4.2%

Condos

Sales: 21

Median Sale Price: $475,000

Average Sq. Ft.: 1,122

Average Price per Sq. Ft.: $486

Average Days on Market: 78

Average Discount from List Price: 6.6%

Although for the full year the average days on market for sold houses was 80, that waiting period declined to just 40 days during the fourth quarter. During that final fall/winter period, 17 houses changed owners, more than half in fewer than 30 days (with seven of those going pending in two weeks or less).

The average price per square foot of sold houses increased 13% year over year, from $421 in 2013 to $475 in 2014 (click to enlarge):

I always caution that this kind of comparison can be misleading since the mix of houses sold (lower market versus upper market) is different from year to year, making it difficult to extrapolate given how small this market is. But the trend is certainly in the right direction, and those who want to compute their own home’s value based on the market rate can use the $475 number as the best current approximation for the neighborhood. House sales in 2014 ranged all the way from $254 per square foot to $947, proving an often-made point about the variability of housing choices in the Park.

Zillow uses current sales prices to compute a home value index for various Seattle neighborhoods. For Madison Park (exclusive of Broadmoor), the median home value is now just shy of $1 million, according to Zillow. As you an see from the chart below (click to enlarge), Madison Park just about back where it was at the height of the market in 2007:

The most expensive house sold in 2014 was a 6,155 sq. ft. modernistic mega-house in Broadmoor at 1515 Parkside Drive, which sold for $4,200,000. That works out to $682 per square foot. The five-bedroom/five-bath home sold in just 14 days, which is not typical for Broadmoor, where 196 days was the average in 2014. Twelve houses were sold in Broadmoor during the year, with a median sales price of $2,326,750. One of these houses sold after 1128 days on the market and another after 907 days. Excluding these two outliers, the average on-market time for sold houses in Broadmoor was only 32 days.

|

| 1515 Parkside Drive East |

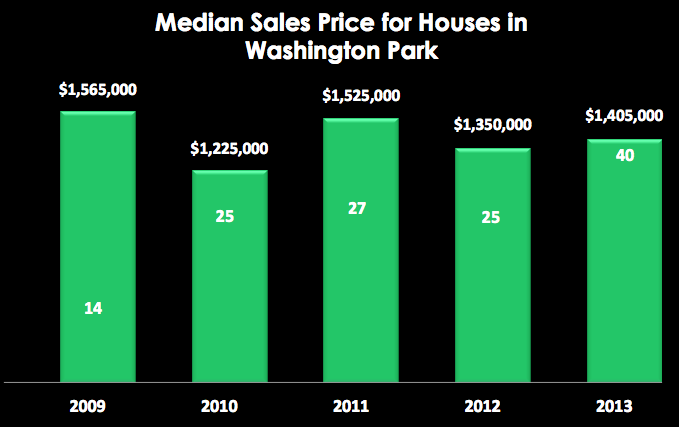

In Washington Park the most expensive house sale was a 5,500 sq. ft. Georgian Colonial house at 1133 McGilvra Boulevard E. This five-bedroom/3.5-bath home sold for $3,803,000, $689 per square foot. The median price of the 26 houses sold in Washington Park last year was $1,512,500, and the average square feet of these was 3,730. These homes sold in 74 days on average.

|

| 1133 McGilvra Boulevard East |

For the rest of Madison Park, the 41 houses sold in 2014 averaged 2,794 square feet. At a median price of $1,200,000 this is an average of $470 per square foot. These houses also had the lowest discount at sale from the original list price, just 2%.

And here’s a very interesting fact: of the 80 houses sold in Madison Park last year, 34 of these (43%) sold at or above their original listing price. Of the 23 houses initially priced at $1 million or less, 17 (74%) sold at or above list. There must have been a bidding war for some of these. For example, one house listed at $625,000 ultimately sold for $755,00 and another house that was listed at $629,000 sold for $765,000. This kind of premium to list did not occur as often in the upper market, but a house listed at $1,850,000 did sell at $2,200,000, 119% of original list.

By the way, the least expensive house sold in Madison Park last year was a 1,450 sq. ft. two-bedroom on E. Madison Street, changing hands at $524,000. There were 11 houses that sold for under $800,000 during 2014, but the days of a “cheap ticket to Madison Park” may be behind us. There is only one house priced at under $1 million in today’s market—and that’s a two-bedroom 1923 cottage (shown at top) which is listed at $840,000.

Expect that baby to be gone soon.

[As always, thanks to Laura Halliday of Windermere Real Estate, for her assistance in compiling market statistics for sold homes, utilizing data from the Northwest Multiple Listing Service. Lower two photos courtesy of Redfin.]